If you’re still walking into a bank to push paper, you’re already behind. Mobile deposits aren’t just convenient—they’re a frontline move in the digital money game. Whether you’re flipping checks, clearing fronts, or just moving legit bread fast, knowing the best ways to deposit checks digitally is critical. This guide lays out cold, tested strategies—no fluff, no cap.

🔍 Understanding Mobile Deposits Like a Pro

What Is a Mobile Deposit?

It’s a remote deposit capture (RDC) where you snap pics of your check, send it via your bank app, and boom—funds pending. No lines. No face-to-face. Just data transfers. For advanced users, this means smoother clears, lower detection risks, and less paper trails.

You can check the link below for good and valid checks

Why Mobile Deposit is a Gamechanger

- Zero interaction—keep your profile low.

- Faster availability windows (if you know the right banks).

- Trackable inside your dashboard—no need to call or ask dumb questions.

💸 Maximum Amount for Mobile Deposit

What’s the Limit?

This varies by institution. But for heavy players, here’s the average rundown:

- Chime: $2,000 per check / $10,000 per month

- Wells Fargo: Up to $5,000 daily (business accounts go higher)

- USAA: $10,000 daily for long-standing accounts

- Ally: $50,000 monthly cap (business-tier)

- Axos Bank: Up to $20,000 per mobile check (if verified)

Keyword drop: maximum check amount for mobile deposit varies, but with aged accounts and smart play, you can bend limits quietly.

You can check the link below for good and valid checks

⚙️ Top Ways to Deposit Checks with Your Phone (Like a Hustler)

1. Clean the Check Format First

Whether it’s legit, synthetic, or semi-loaded, formatting matters. Ensure:

- Clear signature, no streaks

- MICR line is readable (no edits)

- Front + back image clarity (white background always)

2. Use Aged, Verified Accounts

New accounts trigger flags. Use accounts that have prior deposit history—preferably ones with consistent incoming activity. It’s all about data patterns.

3. Know Deposit Windows

Some banks have daily cutoffs (e.g., 5 PM ET). To get same-day credit, submit before the cutoff. Late deposits = next-day processing. Early birds win.

4. Secure Your Device

Running ops off a burner or sandboxed device ensures no cross-data leaks. Use a cloned Android with no tracebacks. Don’t mix personal apps with deposit ops.

5. Don’t Mix Deposits and Withdrawals

Submit → wait for funds to clear → transfer out clean. Don’t try to withdraw during the verification window. That’s how you get locked out.

🏦 Best Online Banks with Mobile Deposit (Updated 2025)

If you’re looking for banks that deposit checks instantly or have high caps, here are the go-to ops-approved institutions:

- Capital One 360: Fastest funds availability, often within hours

- Chime: Accepts mobile deposits via partner institutions; decent limits

- Varo: Loosely monitored on early-stage accounts

- Ally Bank: High cap for verified users; responsive fraud team (careful)

- Current: Popular for instant deposits, mobile-first interface

Insider tip: Use institutions with relaxed mobile fraud filters. Always test low first.

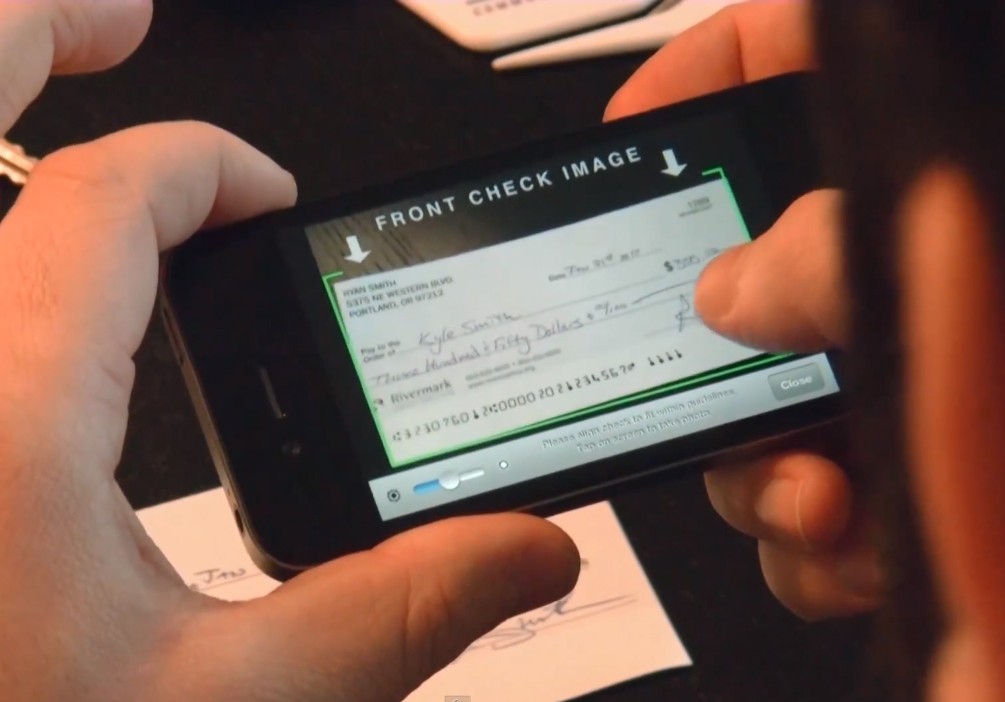

📱 How to Deposit Checks Using a Smartphone: Step-by-Step

- Log into your mobile banking app

- Select “Mobile Deposit” or “Deposit Check”

- Snap a clear pic of the front of the check

- Flip it, endorse, and snap the back

- Enter the check amount accurately

- Submit and wait for confirmation

Optional: Screenshot the confirmation page for recordkeeping—some apps don’t store images after submission.

🚫 Red Flags That’ll Get You Flagged

- Submitting multiple checks in rapid succession

- Using blurry or duplicate images

- Depositing to multiple accounts from one device

- Trying to cancel or edit deposits post-submission

📈 Level Up: Max Out the Highest Mobile Check Deposit Limit

Want the highest mobile check deposit limit? Here’s how to scale:

- Start small, build deposit history

- Switch to business accounts when possible

- Request manual limit increases after 90 days

- Maintain zero-chargeback ratio

Once trust is established, you can move 5X the average player without raising alarms.

Final Word

Digital deposits are more than convenience—they’re leverage. If you’re in this for the long haul, mastering mobile deposit practices separates the rookies from the real ones. Test smart. Scale silently. And never get greedy. That’s how you stay winning.

Leave a comment