Intro: Finessing the Digital Banking System

In 2025, if you’re not running mobile deposits like a surgeon, you’re missing bags. This ain’t the amateur hour with blurry check pics and locked accounts. You’re here for real sauce—the kind CVV runners, carders, and private cashout crews keep buried. Let’s dive deep into the best mobile deposit practices (2025) with precision-level execution.

The Gameplan: What Mobile Deposit Really Means

You’re snapping a pic of a check, flipping digits into digits—nothing new. But the finesse lies in:

- Understanding the maximum check amount for mobile deposit

- Picking the best online banks with mobile deposit and instant drop

- Timing the drop window to avoid flags

- Using image tricks that slide through AI check scanners

Step-by-Step: The Hustler’s Mobile Deposit Protocol

Step 1: Bank Selection – Choose Wisely or Bleed Slowly

Not all banks treat mobile deposits the same. Some freeze fast, others drop faster than cashapp flips. Here’s what you want:

- Chime, SoFi, Varo, Ally – Known for high tolerance & loose scanners

- Bluevine, Capital One 360 – Mid-risk, good for $1K+ pushes

- Best online banks with mobile deposit usually boast auto-clear within 24h

These are the banks that deposit checks instantly—or close to it if you play your timestamps right.

Step 2: Max Limits – Know Before You Snap

Every bank has its daily threshold. Push past that and you’re iced out or worse. Here’s the 2025 rundown:

- Chime: $2,000 per check / $10,000 monthly

- SoFi: Up to $5,000 per check after account seasoning

- Ally: $50,000 daily for long-term users

- Bluevine: $7,500 daily – commercial edge

Always check your app’s fine print. That’s where you find the maximum amount for mobile deposit and how to finesse it.

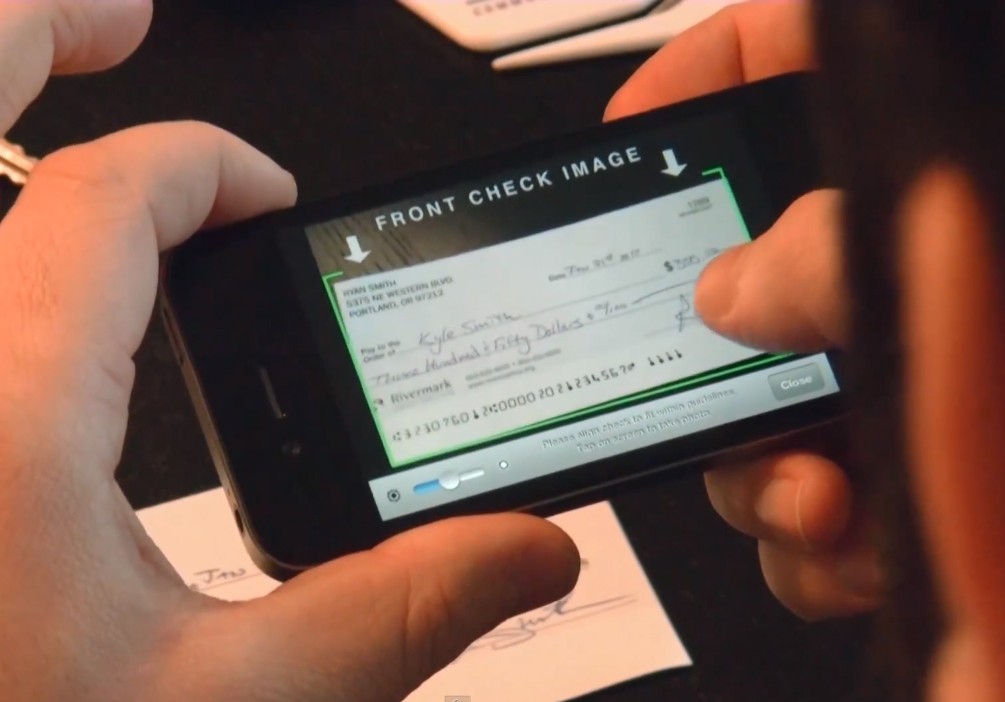

Step 3: Image Finesse – Don’t Just Snap & Pray

AI scanners check brightness, corner alignment, signature legibility. But here’s how pros pass ’em:

- Use a high-res scanner app (not the bank’s default camera)

- Contrast boost: Black-and-white checks read cleaner

- Straighten the edges—sloppy corners = auto-flag

- Cover your tracks: no metadata, scrub GPS from EXIF

This is critical when pulling off the top ways to deposit checks with your phone without flagging any backend systems.

Step 4: Timing – Don’t Hit ‘Em During Rush Hours

Forget 9-5 drops. Those are monitored harder than parole check-ins. Instead:

- Best drop window: Between 2AM–4AM (bank scanner backlogs, less real-time review)

- Weekends: Avoid Fridays—funds held till Monday

- Holidays: Total no-go. Delay magnet.

Advanced ops always work around scanner review cycles. That’s how you ensure the highest mobile check deposit limit gets cleared without getting capped.

Step 5: Clean Withdrawals – Don’t Get Greedy

Once funds land, don’t yank the whole pot. Play it slow:

- Split withdrawals over 2-3 days

- Use external wallet-to-wallet transfers (Cash App > Coinbase > Revolut)

- Convert to crypto or stablecoin if you’re doing volume

That’s how the pros make moves without tripping wires. Because clearing the deposit is one thing—touching it is where most fumble.

Underground Pro Tips

- New accounts? Keep initial deposits under $500 for 2 weeks

- Backdate checks slightly (1–2 days prior) for smoother scanner approval

- Test checks from legit sources first—build trust score

- Clone layout templates if you know how—advanced crews will get the hint

Final Word: Play Smart, Stay Ghost

Don’t confuse fast with sloppy. The ones still cashing out in 2025 know it’s not about pressing max buttons—it’s about making every press count. Whether you’re moving payroll checks, business refunds, or deeper plays, these best ways to deposit checks digitally only work if you stay surgical.

Master the system. Exploit its blind spots. And remember: silence is your best receipt.

Leave a comment