Are you tired of waiting in long bank lines to deposit checks? Mobile deposit is revolutionizing the way we handle our finances. This comprehensive tutorial will walk you through the process of mobile deposit, ensuring you can effortlessly manage your money from the comfort of your smartphone.

Also read: The 2025 Guide to Understanding CC Dumps and Sites

What is Mobile Deposit?

Mobile deposit, also known as remote deposit capture, is a convenient feature offered by many banks that allows customers to deposit checks using their mobile devices. By simply taking a photo of the check, users can securely deposit funds into their accounts without visiting a physical bank branch.

Essential Requirements for Mobile Deposit

Before you begin, make sure you have the following:

- A smartphone (iOS or Android)

- Your bank’s mobile app

- A valid check for deposit

- A stable internet connection

Step-by-Step Mobile Deposit Tutorial

- Download and Set Up Your Bank’s App

Visit your device’s app store and download your bank’s official mobile application. Once installed, log in using your online banking credentials.

- Locate the Mobile Deposit Feature

Navigate through the app’s menu to find the mobile deposit option. This may be labeled as “Deposit Check” or “Mobile Deposit” depending on your bank.

- Enter Check Information

Input the check amount and select the account where you want to deposit the funds. Some banks may require additional details, such as the check number.

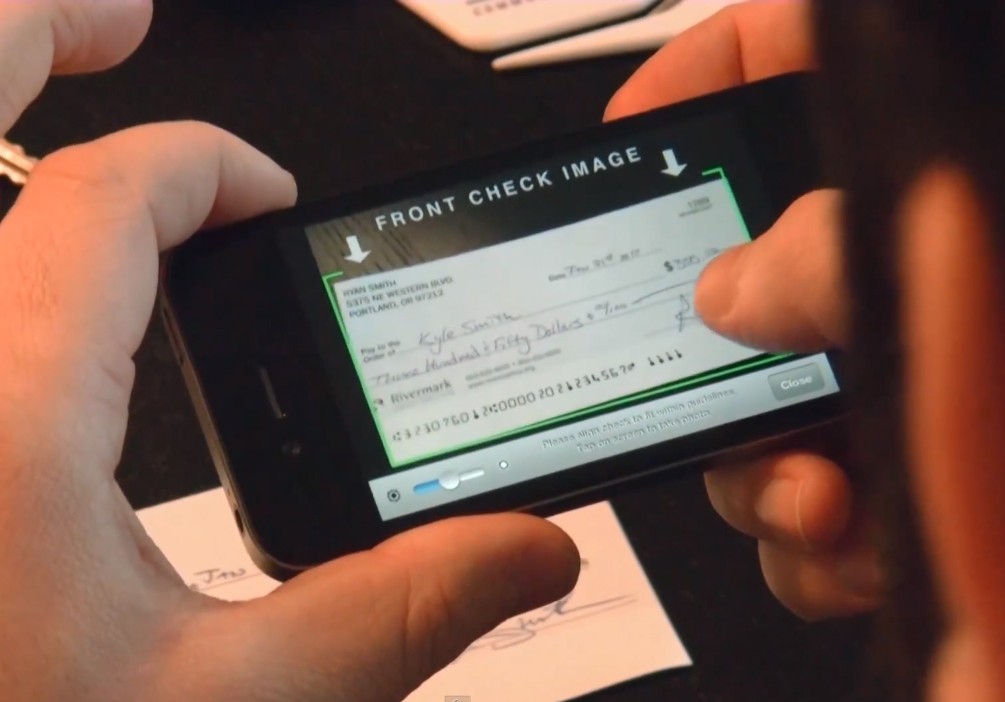

- Capture Check Images

Follow the app’s instructions to photograph both the front and back of the check. Ensure proper lighting and a clear, flat surface for best results.

- Verify and Submit

Review the information and images for accuracy. If everything looks correct, submit your deposit for processing.

- Confirmation and Record-Keeping

You’ll receive a confirmation message once your deposit is successfully submitted. Keep the physical check for a specified period as advised by your bank.

Best Practices for Mobile Deposit

- Endorse the check properly, including any required mobile deposit annotations.

- Use mobile deposit in a secure, private location.

- Monitor your account to ensure the deposit is processed correctly.

- Be aware of your bank’s mobile deposit limits and cut-off times.

Troubleshooting Common Mobile Deposit Issues

- Blurry Images: Ensure steady hands and good lighting when capturing check images.

- Deposit Limits: Check your bank’s policies for daily and monthly deposit limits.

- Delayed Processing: Some banks may hold funds for a certain period, especially for large deposits.

Mobile Deposit Security Tips

- Use a secure Wi-Fi network or your cellular data connection.

- Keep your banking app updated to the latest version.

- Enable two-factor authentication for added security.

- Never share your login credentials with anyone.

Conclusion

Mobile deposit offers a convenient, time-saving solution for managing your finances. By following this complete tutorial, you’ll be able to confidently use mobile deposit features, streamlining your banking experience and saving valuable time. Embrace the future of banking with mobile deposit technology!